The supplier-buyer relationship has long been a cornerstone of the maritime industry, playing a vital role in ensuring seamless port calls and efficient operations. In today’s rapidly changing environment, these relationships are evolving. Advances in technology, evolving regulations, heightened security concerns, and a growing emphasis on sustainability are all reshaping the maritime landscape.

As a result, procurement leaders are under increasing pressure to deliver cost savings while improving business continuity and efficiency. With global supply chains becoming ever more complex, many organisations are turning to vendor consolidation as a strategic response. Understanding the driving forces behind this shift, along with its financial and operational benefits, as well as the risks of relying on fewer partners, is crucial for navigating the evolving landscape.

The Current Landscape: Quantitative Drivers and Risks

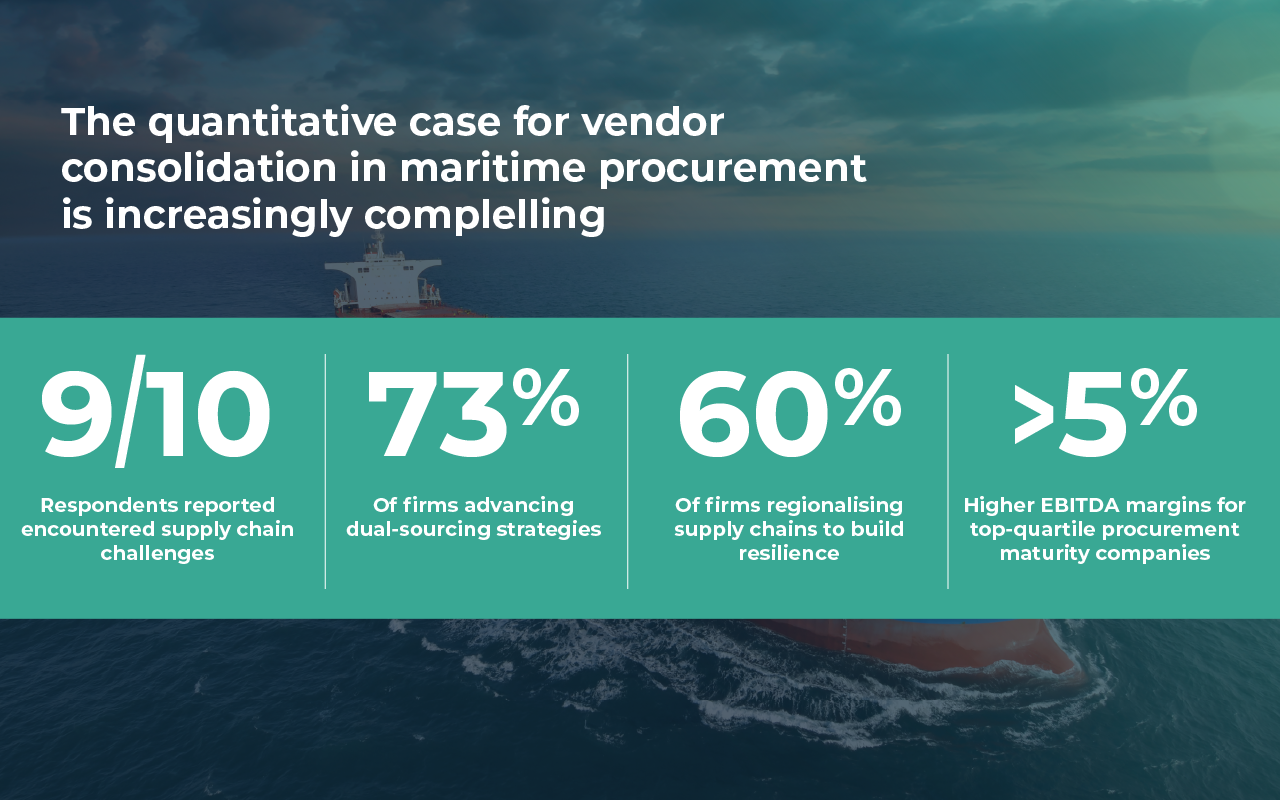

The quantitative case for vendor consolidation in maritime procurement is increasingly compelling. McKinsey’s Global Supply Chain Risk Survey 2024 reports that nine in ten respondents reported encountering supply chain challenges in 2024. The same study shows that 73% of firms are advancing dual-sourcing strategies and 60% are regionalising their supply chains to build resilience.

Companies with top-quartile procurement maturity – often characterised by strategic supplier consolidation – achieve EBITDA margins at least five percentage points higher than their less mature peers, highlighting the link between procurement maturity and profitability.

At the same time, BCG warns that consolidation requires balance, noting that geopolitical volatility and maritime chokepoints such as the Red Sea and Panama Canal increase systemic supply-chain risk. Their analysis emphasises that procurement leaders must consider cost, risk, sustainability, and market access holistically rather than focusing solely on the lowest-cost sourcing.

Together, these pressures are accelerating the shift towards vendor consolidation, creating leaner, more strategically managed supplier networks that enhance compliance, risk management, and alignment with ESG objectives.

Vendor Management Headaches

For ship owners, operators, and managers, vendor management remains a persistent operational challenge. Managing hundreds of suppliers, from spare parts and technical services to consumables and provisions, is complex, especially when vessels operate across multiple jurisdictions and regulatory regimes. Deloitte reports that organisations are employing a range of strategies and technologies to realise value in their supply chains . The major pain points reported for vendor management include:

- Lack of transparency and standardisation

Vendors use inconsistent documentation, pricing models, and communication channels, making it hard for customers to compare performance or costs. - Procurement inefficiencies

Manual quotation and approval processes cause delays in critical maintenance or supply deliveries, impacting operational schedules. - Compliance and risk monitoring burden

Tightening international standards increases complexity, especially as vendor networks become more fragmented. - Poor visibility across supplier tiers

Only 30% of maritime companies have visibility beyond tier-one suppliers, creating compliance and operational risks. - Data fragmentation

Disconnected information across fleets, ERP systems, and port agents forces ship managers to react to problems instead of preventing them.

These challenges not only inflate operating costs but also threaten vessel uptime, safety, and overall supply chain resilience.

These challenges not only inflate operating costs but also threaten vessel uptime, safety, and overall supply chain resilience.

The High Cost of Reactive Procurement

A key challenge in vendor consolidation is the tendency toward reactive procurement, which disrupts efficiency and reliability. When last-minute procurement issues arise during port calls, operational schedules become chaotic as crews scramble to source critical parts or services, often under severe time pressure. This disrupts coordination between port authorities, vendors, and shipping lines, leading to congestion and strained resources. Delayed departures can cascade into missed berthing slots, forcing vessels to wait and amplifying port congestion. In 2024, global schedule reliability averaged just 50–55%, with late vessel arrivals causing an average delay of 5.28 days. Also, during peak disruption periods, some ports are reported wait times of 10–14 days.

Strategic vendor partnerships help address these challenges. By consolidating suppliers and establishing long-term agreements, shipping companies can secure pre-negotiated service levels, real-time inventory visibility, and proactive maintenance planning. This approach reduces the need of reactive procurement and improves schedule reliability.

According to PwC’s Global Shipping Survey, companies leveraging strategic partnerships report 22–31% lower logistics disruption costs and significantly faster response times during unplanned events. These partnerships transform vendor management from a reactive burden into a strategic advantage, enabling ports and shipping lines to maintain operational flow under pressure.

The Risks of Consolidation

While vendor consolidation brings clear efficiencies, it also introduces significant risks that shipowners, operators, and managers must address. Over-reliance on a limited supplier pool can amplify operational disruptions if a key vendor experiences delays or production issues.

From a compliance and risk perspective, concentrating suppliers can increase systemic exposure; for example, if a primary vendor faces cyber vulnerabilities or ESG non-compliance, multiple vessels or operations may be impacted at once.

These realities illustrate that while vendor consolidation can streamline operations, it is not a one-size-fits-all solution and must be balanced with careful risk management and strategic planning.

Unlocking the Benefits

Despite the potential drawbacks, vendor consolidation can deliver significant benefits when executed strategically. One of the main advantages is cost efficiency: working with fewer, high-performing suppliers may allow shipowners and operators to negotiate better pricing, reduce administrative overhead, and lower procurement cycle times.

Consolidation also enhances operational visibility and control, making it easier to monitor supplier performance, ensure compliance with safety and ESG standards, and track inventory across fleets. This oversight reduces the likelihood of supply disruptions, fraud, or non-compliance issues.

Streamlined vendor networks also simplify logistics and administrative tasks, reducing the burden on procurement teams and freeing resources to focus on value-adding activities.

Conclusion: Striking the Right Balance

Vendor consolidation in the maritime industry can offer significant advantages when implemented thoughtfully. Streamlining suppliers may lead to lower procurement costs, simplified logistics, improved compliance oversight, and stronger strategic partnerships. However, relying too heavily on a limited set of vendors can introduce risks, including supply disruptions, reduced flexibility, and potential exposure to operational or compliance failures.

The key for ship owners, operators, and managers is to approach consolidation strategically, striking a balance between efficiency gains and prudent risk management. A balanced approach, which involves selecting high-performing and reliable suppliers while maintaining some diversification for critical parts and services, helps mitigate risks and unlock efficiency.

Robust vendor oversight, predictive procurement planning, and strong contractual frameworks can be a tool for resilience rather than vulnerability. When managed carefully, vendor consolidation becomes a way to improve reliability, reduce costs, and strengthen supply chain partnerships. Ultimately, there is no one-size-fits-all solution; success depends on finding the right partner and maintaining a long-term strategic mindset.

Marine Supply Chain Hub

At Inchcape, we strive to be a trusted partner for your marine supply chain needs. We recognise that shipping operations can be unpredictable, and complex challenges may arise anywhere in the world. Our team is available to provide prompt assistance and expert advice whenever you require it. We address logistics, procurement, and warehousing challenges by offering a single point of contact, leveraging a global network with local expertise. Our qualified vendor network facilitates efficient management of operational requirements for vessels and projects, supporting rapid turnaround times and competitive pricing.

References

(1) McKinsey & Company (2024) Supply chains: Still vulnerable – Global Supply Chain Risk Survey.

(2) McKinsey & Company (2024) Where procurement is going next.:

(3) BCG (2024) These four chokepoints are threatening global trade.

(4) BCG (2024) How geopolitics changes the procurement equation.

(5) Deloitte (2024) Global supply chain resilience amid disruptions.

(6) Achilles (2024) Lack of supplier visibility in the maritime sector.

(7) Sea-Intelligence (2024) Global Liner Performance Report – Schedule Reliability.

(8) SeaRates (2024) Delays Increase by 300% in World Ports: Key Insights About the Summer Peak Collapse.

(9) PwC (2025) Global Shipping Survey – Procurement Outlook.