In this second instalment of Inchcape’s Global Shipping Report, Thomas Alexa, Senior Analyst for Europe and Americas at global maritime risk management company Ambrey, recaps the key regional security threats in the first quarter, while Jacob Guldager, Business Development Director at global transit agency LETH, provides an update on Suez and Panama Canal issues and key bunkering/husbandry locations for vessels re-routing around the Cape of Good Hope.

In Q1, Ambrey recorded over 881 maritime security events globally, averaging 286.3 events per month. Over 28% of these pertain to war risk, followed closely by instances of crime (such as narcotics and robberies) at 23%. The number of events rose by 55% versus Q1 2023, compounded by a notable increase in severity. There was rise of over 200% in instances of physical damage and an over 300% rise in the number of extended-duration robberies. Pirate action groups and narco/human traffickers, and as well as militants, are displaying a greater propensity towards higher levels of violence.

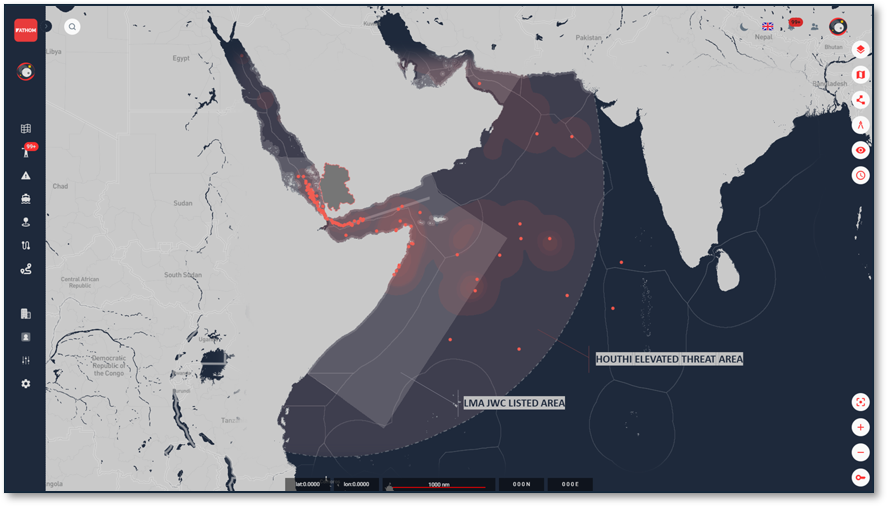

Southern Red Sea / Gulf of Aden / Indian Ocean

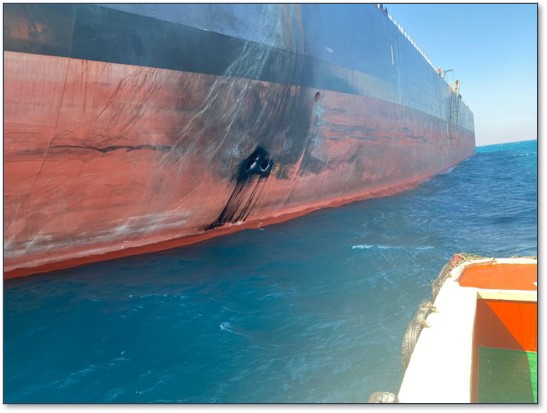

1)The Houthi threat remains high, with no signs of decrease in operational tempo. So far in 2024, Ambrey recorded 40 Houthi-related maritime security (Marsec) events, despite many vessels avoiding the area. In the majority of the attacks, perceived affiliation of the vessel owner to the US, Israel or UK and overseas territories and vessels’ proximity to Yemen are the main drivers. The significant fall in Suez Canal volumes and sharp rise in Cape of Good Hope traffic clearly shows the Houthis are succeeding, and so far the global community has not found an adequate response.

For those considering transiting the Red Sea and Suez Canal, our advice is to conduct a comprehensive voyage threat assessment well in advance, including evacuation thresholds. Vessel digital-footprint corrections made once the targeting began have proven to be largely fruitless. The Houthis may draw information from older databases, so it is essential to get your vessel affiliation checked. Regarding the effectiveness of withholding AIS, Ambrey’s analysis clearly shows that, thus far, this does not decrease the likelihood of being targeted but substantially reduces the efficacy of targeting.

2) Somali piracy resurged in Q1 and several successful hijackings have taken place. The suppression of piracy over the last few years led to complacency, with far fewer vessels embarking private security teams. After the hijackings, the use of armed guards has surged once again.

The key lesson here is that democratisation of access to weapons and reconnaissance systems, once the exclusive purview of nation states, is heralding a new landscape where non-state actors, including insurgent groups, criminals, criminal syndicates and terrorist organisations now wield such capabilities. Shipping is now confronted with a myriad of previously unforeseen threats, from asymmetric attacks to clandestine surveillance. This underscores the imperative to adopt more agile and adaptive security strategies.

Rest of the world

In the Black Sea, the maritime domain of the Ukraine/Russia conflict has become more pronounced, with the increased use of unmanned systems, notably unmanned surface vehicles (USVs), presenting a material threat to shipping. While a direct attack is unlikely, the threat of misidentification remains.

In China and Taiwan, the political and military tensions between two countries remain heightened. This should be closely monitored in case of escalation of the conflict to avoid a situation that arose in Ukrainian ports after the renewed Russian invasion.

In Russia, Ukrainian unmanned aerial vehicles carried out successful attacks on Russian Baltic Sea ports and numerous oil refineries. This marked an elevation in the threat of collateral damage in those ports. Debris from shot-down UAVs have been known to cause damage to vessels.

The surge in violence and breakdown of law and order in Haiti pose an increased threat to merchant shipping, with Ambrey receiving first-hand accounts of vessels being struck by small arms fire at the port.

Notable absentees

One prime example of an area that was previously perennial in security recaps is the Gulf of Guinea. Oil exports from the region have fallen, and there has been a palpable decline in instances of West Africa piracy. This positive trend can be attributed to the enduring partnership between private and public entities that has created a robust security infrastructure.

In Mozambique, although the security situation remains tenuous and there have been some kidnappings in the past few weeks, there have been signs of improvement with many internally displaced people returning home and LNG projects in the process of restarting.

The Essequibo territorial dispute between Guyana and Venezuela persists but has not escalated into armed conflict thanks to diplomatic and commercial negotiations. And in the Eastern Mediterranean, despite the ongoing conflict in Gaza and rocket attacks on Israel, not a single vessel has been damaged, and Israeli ports continue to operate.

Narcotics

Beyond a specific geography, narcotics smuggling aboard merchant vessels has reached endemic levels. The arrest of port officials and law enforcement agents, crew and masters highlights the extent of penetration by organized narcotics groups into the industry. This is further underscored by both low narcotics prices in Europe and the US.

Humanitarian search-and-rescue (HS&R)

Spanish government figures indicate a rise of over 600% in irregular migrants arriving by sea in Q1, while the huge sums spent by European nations on curbing the issue have not proven wholly effective. In particular, irregular migration across the Western Sahara and Canary Islands area has evolved into multifaceted challenge encompassing political safety and security, as well as concerns for shipping.

Ambrey recorded a 93.7% increase in HS&R-related business interruptions compared to Q1 2023 in this area. The majority of rescue operations are initiated in response to directives from national MRCCs, but there are also instances of inadvertent encounters with small boats in distress. The length of time vessels engage in such operations varies between four to 45 hours, contingent on factors including weather conditions, the size and condition of the rescued group, and the availability of the nation-state S&R vessels.

HS&R in this area involves challenges markedly different to the Mediterranean or English Channel. Vessels that traditionally use the Suez Canal are also now transiting the area, and many companies and masters may not be aware of the scale of the risk (for example, the associated cost of a rescue operation once initiated averages half-a-million dollars).

In the Med, there are regular patrols by Italian, Tunisian, Libyan and Greek MRCC operations, as well as MRCC reconnaissance flights from Italy and Turkey. Supranational institutions such as Frontex also patrol the area. In addition, there are up to 12 NGO vessels offering to rescue people. However, only the Spanish and Moroccan MRCCs operate off Western Sahara and the Canaries. The size of the small boats is also larger, averaging 40 to 80 passengers while in the Med they average 25 to 40 passengers.

Merchant vessels are unprepared to conduct these kinds of operations, lacking specific training and equipment. Sometimes accompanied by minors, rescued individuals are prone to panic, which has previously led to aggression towards the rescuers. There are often medical emergencies among the rescued that may necessitate medical triage and subsequent urgent attention. In some cases, there may be security threats posed by criminal elements among the rescued. The pressure on crew and masters during such operations is considerable and may lead to injuries and lifelong trauma. Masters can use Ambrey’s rescue advice management practice (RAMP) checklist as a resource in HS&R operations and to mitigate associated risks.

Suez Canal

The Red Sea situation has hit the Suez Canal hard. So far in 2024, an average of only 41 vessels have transited per day and only 36 per day in March, versus an average of 65 vessels daily in 2022 and 72 in 2023. Containerships are the canal’s biggest revenue source, with an average of 16 boxships transiting per day in 2023. In February 2024, the tally was 73% down to four or five per day, meaning a huge drop in income.

Despite this sad situation the Suez Canal Authority (SCA) continues to offer long-haul rebates in addition to its fixed rebate system (more details on the LETH website here). Whenever a voyage can be calculated as more expensive than an alternative route, the SCA will study each application case by case (click here for a table of recently obtained long-haul rebates). Sailing through a high-risk area or piracy area will ultimately result in a higher rebate. Remember to apply no later than 48 hours prior leaving the last port.

Security team best practices

For vessels considering having security teams on board while transiting the Suez Canal, unarmed security teams are permitted on board, however weapons and security equipment are not. Such materiel should be offloaded on arrival – or prior to transiting the Canal – at Suez or Port Said, subject to pre-coordination with the Suez Navy Base or the Port Said Navy base, respectively, at least three days prior to arrival. LETH can coordinate transport with both Navy Bases to re-deliver materiel post-transit. Offloading many sets of weapons and equipment is subject to additional charges.

Key bunker locations for re-routing vessels

For vessels opting to trade around the Cape of Good Hope, the three key alternative bunkering locations are Mauritius, Gibraltar/Algeciras and the Canary Islands. Mauritius can offer bunkering X-pipe at berth or at anchor. The anchorage area allows deep draft with a multitude of positions. Along with bunkering options, LETH and Inchcape can provide husbandry services to maximize operations.

Gibraltar and Algeciras both provide X-pipe bunkering at anchor or at berth, depending on vessel size. There are some congestion delays, with an average turnaround of six hours. Bunker calls are subject to a 75% port-use discount. In the Canaries, bunkering is available at Tenerife via berth (subject to availability) and at Las Palmas via pipe, truck at berth. Bunker quality and husbandry services are available on request.

Panama Canal

The daily count of vessels passing through the Panama Canal slowly fell during 2023 as a result of the ongoing drought. In November, the Canal opted to gradually decrease the maximum number of vessels transiting per day from 37 to 22 over a three-month period. Since January, the average has been steady at around 23 per day. Basically, only pre-booked vessels are now allowed to transit. Slots still available are getting huge amounts at auctions held seven to two days prior to transiting. In March, the average price for an auction slot was $387,000 in the new Panamax locks and $176,000 for the Panamax locks.

On a positive note, the rainy season is expected to start sooner than forecast, and from 18 March the ACP increased capacity from 24 to 27 vessels daily, however only for the Panamax locks initially.

Although some of the developments described in this update may evoke apprehension, there are grounds for optimism. As threats become more complex the industry must become more proactive. Synergistic collaboration with government and private security providers is vital to strengthen resilience.